can a tax attorney negotiate with irs

The answer is yes and in many simpler cases there is no benefit to hiring. A tax lawyer can work with you to develop a reasonable offer and negotiate the terms with the IRS.

When And Why Would You Need An Irs Tax Attorney The Inside Scoop Defense Tax Partners

Tax attorney Beverly Winstead says there are many aspects of negotiating with the IRS you can do yourself but there are some situations where a professional can help.

. The answer is yes The tax attorney can and often should negotiate with the IRS. Every tax case is different so you can trust us to craft a tax debt negotiating strategy that will work specifically for your situation. Can a tax attorney negotiate with IRS.

In fact having a tax attorney could even lower your tax bill. The next option can occur after you file your taxes and receive a bill from the IRS. In addition to negotiating with the IRS on your behalf a tax attorney may be able to dissuade the IRS from pursuing lines of questioning that are inappropriate.

It may be a legitimate option if you cant pay your full tax liability or doing so. When it comes to taxes its always the best idea to act. Tax lawyers can save you pennies on the dollar.

At this point you can either negotiate or hire a tax lawyer because your case will be much stronger with an. If your tax liability is higher than that you will need to submit Form 9465. A tax attorney can help you deal with the IRS.

Installment Agreements Enable Payment Over Time. A more specific example of the negotiating benefits of having a tax attorney deal with the IRS is when you are seeking an offer in compromise. Penalties can drive up your back taxes significantly making.

You can grant a third party authorization to help you with federal tax matters. Can a Tax Attorney Negotiate With IRS. O IRS will fax up to 10 transcripts.

Here we answer the commonly asked tax relief question. A tax attorney can also negotiate settlements with the IRS on their behalf. This negotiation starts with their first contact with the IRS.

Who can help negotiate with IRS. IRS Tax Disputes Most tax disputes arise in the form of an audit of one or several past tax returns. For example if you owe 50000 in back taxes an.

An offer in compromise allows you to settle your tax debt for less than the full amount you owe. How Can a Tax Attorney Help You Negotiate With the IRS in Fort Smith AR. An offer in compromise OiC is a negotiation with the IRS where a taxpayer tries to eliminate some of the debt owed to the IRS.

Your attorney can negotiate on. Payment plans differ and an experienced attorney can. If come the tax filing deadline you owe the IRS an amount that you cannot pay in one lump sum it is important to file the return anyway says Lawrence Brown an.

While a tax resolution may seem complex an attorneys extensive knowledge of the law can make the. An installment agreement can be a great way to pay back the IRS at. The third party can be a family member or friend a tax professional attorney or business.

You can go online to complete an application for this kind of extension or you can call the IRS at 1-800-829-1040. Hiring a Tax Attorney Can Lower Your Tax. First of all.

However tax lawyers can negotiate agreements with the IRS such as offers in compromise that allow you to pay less than your total balance. If the IRS notifies you of an audit you should hire a tax attorney immediately. Following are the ways a tax attorney can help you negotiate with IRS.

Another reason is that the longer you take to pay back the IRS the more penalties they can add to your already existing debt. And by representing you the IRS will take your negotiations more seriously. Control over the Negotiations.

An offer in compromise can be. Depending on your situation they can help you negotiate an offer an compromise remove penalties set. Can I negotiate with the IRS myself.

12 Things You Must Know to Negotiate a Favorable IRS Tax. If you owe more than 10000 consider hiring a tax attorney to negotiate with the IRS.

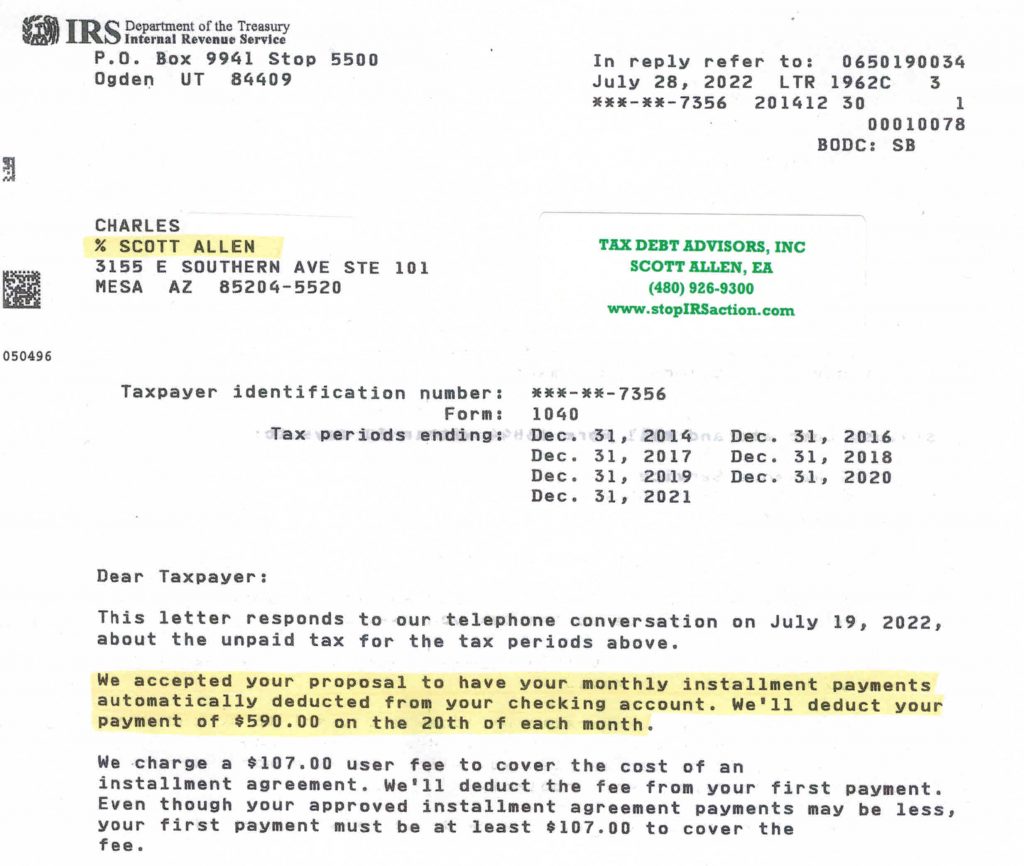

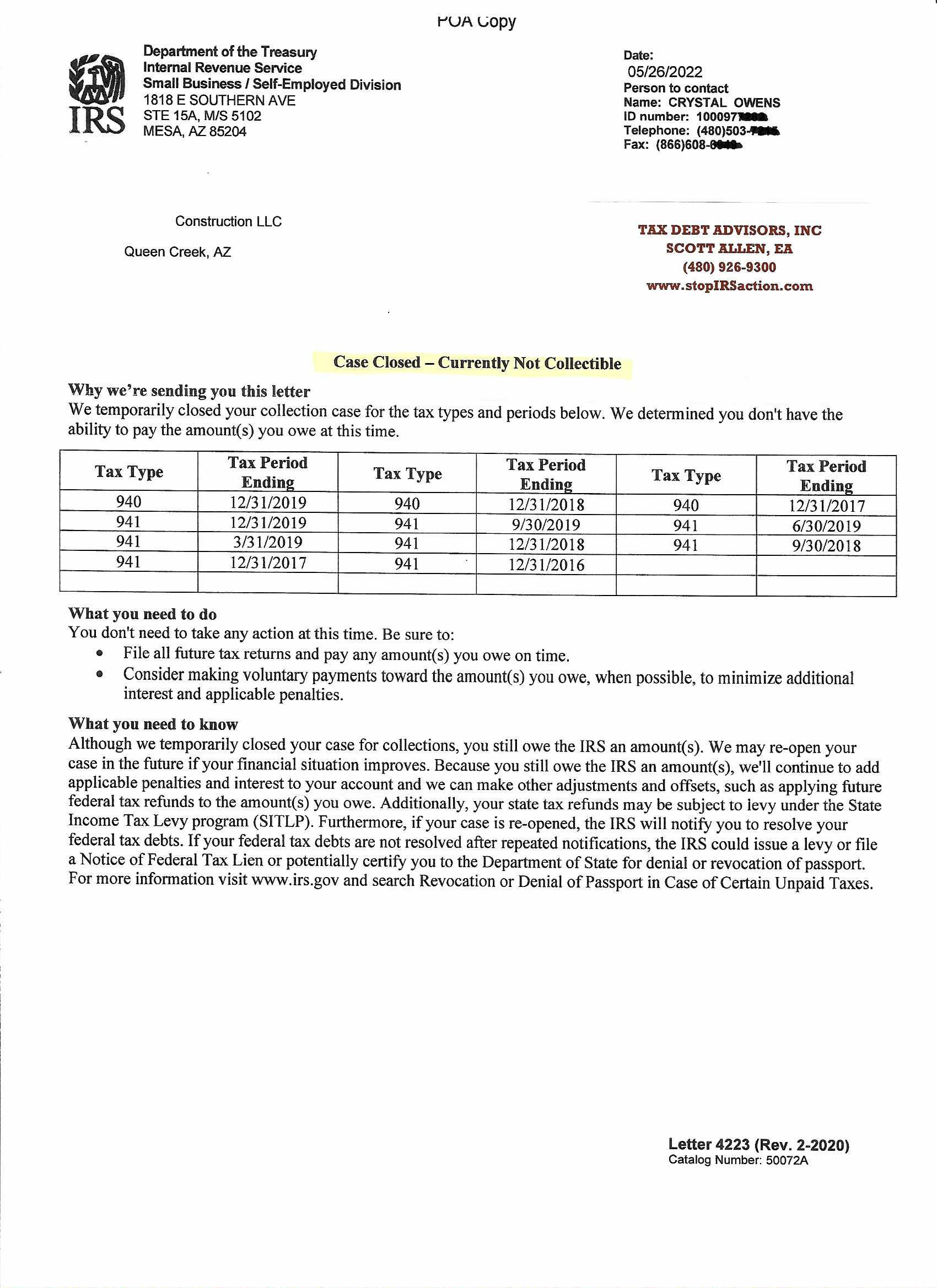

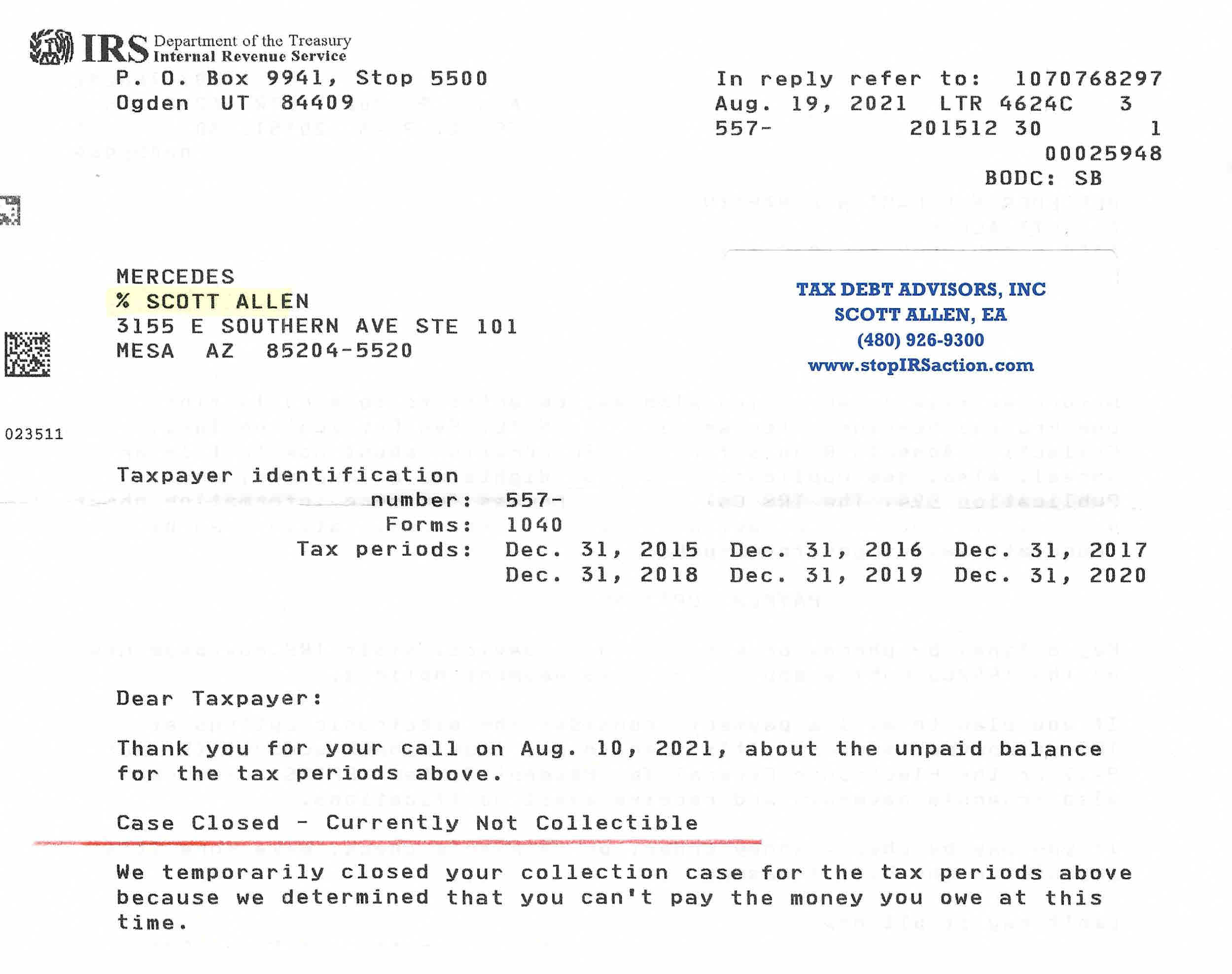

Phoenix Az Irs Tax Attorney Tax Debt Advisors

Irs Tax Attorney Tax Debt Advisors

When Do You Need An Irs Lawyer Tax Hardship Center

:max_bytes(150000):strip_icc()/TaxSettlementFirms-4917d3d3214f4a808b0348901c1ffc6a.jpg)

The Truth About Irs Tax Settlement Firms

Chandler Az Irs Tax Attorney Tax Debt Advisors

Chicago Tax Lawyers Elmhurst Tax Attorney Illinois Irs Lawyer

Irs Tax Attorney Page 3 Tax Debt Advisors

11 Tips To Negotiating An Irs Tax Settlement Ayar Law

Irs Tax Attorney Tax Debt Advisors

Irs Tax Audit Attorneys Tax Law Offices Of David W Klasing

Negotiating Payment Plans With The Irs Taxcontroversy Com

Chicago Tax Lawyers Elmhurst Tax Attorney Illinois Irs Lawyer

Irs Offer In Compromise In Okc The Carver Law Office Pllc

When Does It Make Sense To Hire A Tax Attorney

Negotiate With The Irs Offer In Compromise Wiggam Law

Tax Settlements Negotiations Attorney Columbus Oh

2 Important Advantages Of Hiring A Tax Lawyermichael C Whelan Jd Cpa

/negotiating-with-the-IRS-2000-e308b3d42dff402391b55fb438046fd1.jpg)